52+ can mortgage insurance premiums be deducted in 2020

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage.

Mortgage Insurance Premium Deduction Extended Crosslin

In the past you could claim.

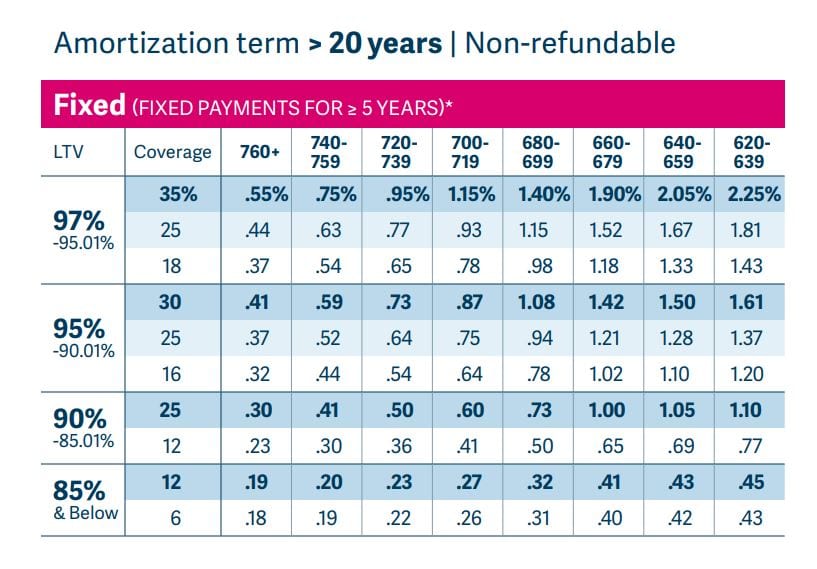

. With all of the media publishing articles about the tax reform it is. All mortgage insurance premiums are subject to an income phase-out. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid. Web Deduction for mortgage insurance premiums as qualified residence interest under Section 102 of the Act The deduction for certain mortgage insurance premiums has. Web Until the 2017 Tax Cut and Jobs Act mortgage insurance premiums were deductible in addition to allowable mortgage interest.

Web I just reached the correct level person at the Alabama Dept of Revenue who was knowledgeable and who stated that the booklet is wrong and that you CAN TAKE. Web Many home buyers are wondering if private mortgage insurance or PMI is still tax deductible in 2022. Web Most mortgage insurance premiums For tax year 2020 if your adjusted gross income AGI is more than 109000 as a married couple or 54500 if filing.

The PMI policys mortgage had to. Web Mortgage insurance provided by the Department of Veterans Affairs and the Rural Housing Service is commonly known as a funding fee and guarantee fee respectively. Be aware of the phaseout limits however.

TurboTax has to wait for the IRS to publish procedures and revised forms for all the changes and then it. But only if you itemize. Web The VA funding fee is considered a mortgage insurance premium.

Web When you file your income tax return in 2020 for the 2019 tax year you will no longer be able to deduct mortgage insurance payments. Web But to get an idea of the savings available lets say your adjusted gross income is 100000 and youre paying 120 per month in PMI premiums. Web How to Deduct Your Upfront Mortgage Insurance Premiums The mortgage insurance deduction is back at least through 2020.

Web When the deduction for PMI costs were last regularly available for MI premiums paid though 2021 there were limitations. 1 However the Further. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

If you paid a really. Web Its not just the mortgage insurance premium deduction.

How Much Does Private Mortgage Insurance Pmi Cost Valuepenguin

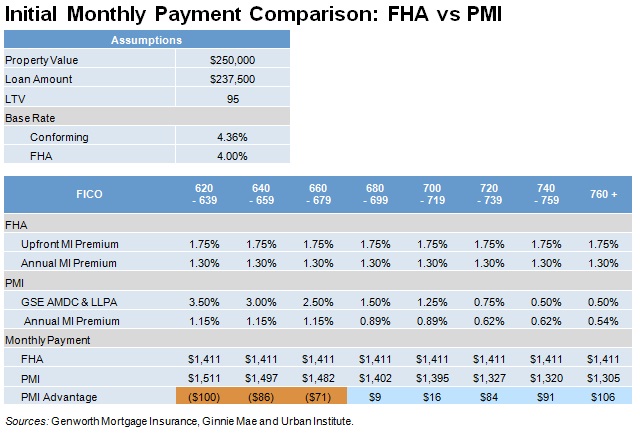

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

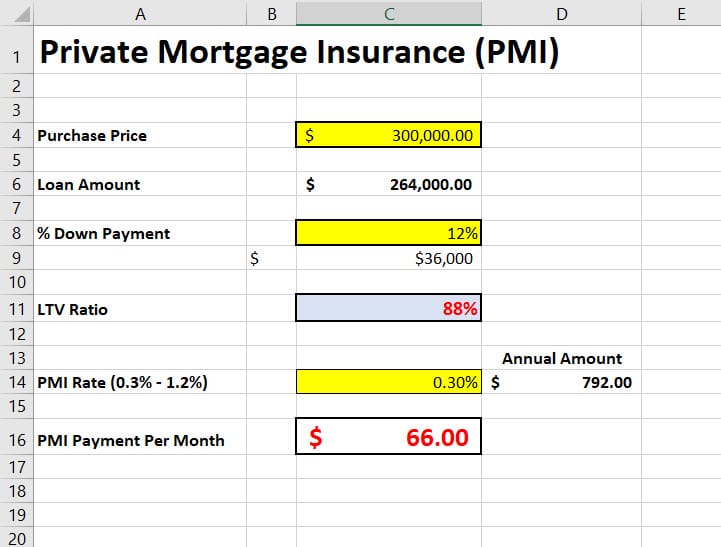

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Pros Cons Of Disaster Mortgage Insurance

Is Mortgage Insurance Tax Deductible Bankrate

![]()

Ev Energy Credits New Tax Deductions

Pdf The Role Of Consumer And Mortgage Debt For Financial Stress

Ev Energy Credits New Tax Deductions

Is Private Mortgage Insurance Pmi Tax Deductible

Ex 99 2

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

What Is A Mortgage Insurance Premium What You Should Know About This Mortgage Insurance Advisoryhq

Pmi Private Mortgage Insurance Frequently Asked Questions Answers

Top 9 Tax Deductions And Credits For Sole Proprietors

Top 9 Tax Deductions And Credits For Sole Proprietors

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Loan Apply Home Loan Online Housing Loan Online Creditmantri